how to pay indiana state taxes quarterly

Find Indiana tax forms. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

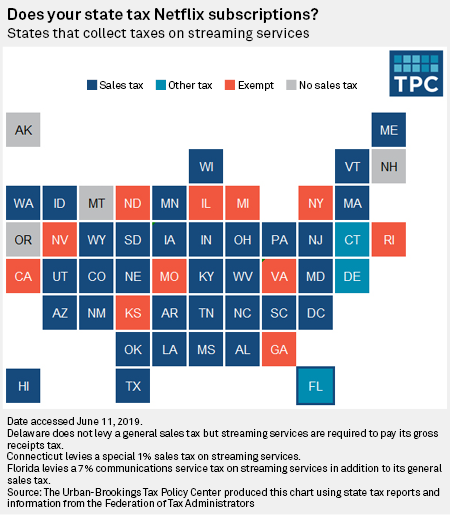

More Us States Introduce Streaming Tax S P Global Market Intelligence

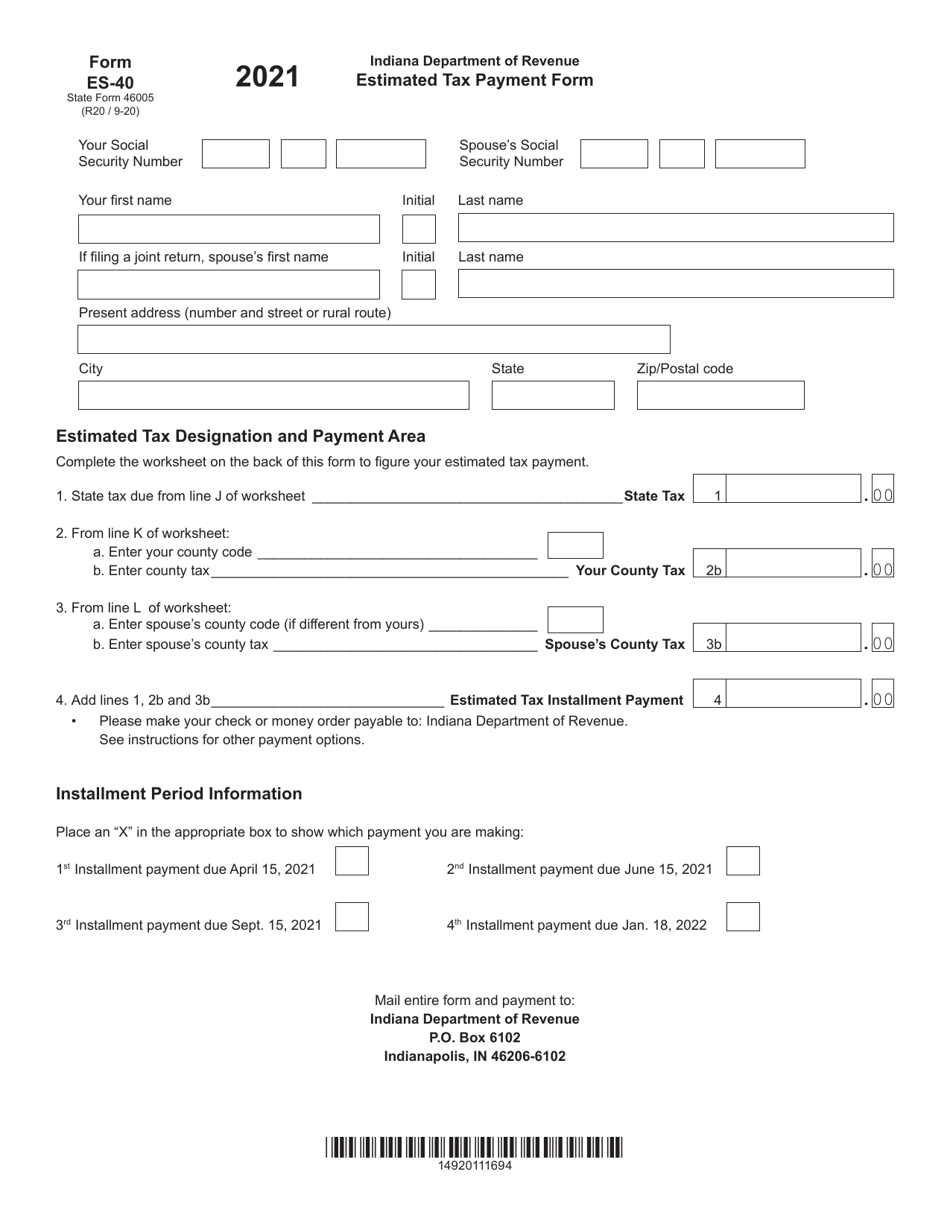

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Know when I will receive my tax refund. Estimated payments may also be made online through Indianas INTIME website.

Claim a gambling loss on my Indiana return. Access INTIME at intimedoringov. How much money can you inherit without paying inheritance tax.

To make a payment via INTIME. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate. Line I This is your estimated tax installment payment.

Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. Find Indiana tax forms. Pay my tax bill in installments.

Make a payment online with INTIME by electronic check bankACH - no fees or. The tax bill is a penalty for not making proper estimated tax payments. Know when I will receive my tax refund.

Take the renters deduction. The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

How to Pay Quarterly Taxes. Select a payment method. Choose the amount you want to pay and your payment method.

You will be redirected to a payment portal. Under non-bill payments click your payment method of choice. Scroll down and navigate to Make a Payment in the Payments section.

Have more time to file my taxes and I think I will owe the Department. So if you discover youre required to pay quarterly taxes you must first use Schedule C of Form 1040 to determine how much you owe. Lines J K and L If you are paying only the.

To make a payment sign in to INTIME head to the Summary page tab and locate the Make a payment hyperlink in the associated tax account. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax. If youre self-employed you need to pay federal estimated quarterly taxes for the income you make.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one. Some states also require estimated quarterly taxes. Once logged-in go to the Summary tab and.

Enter your SSN or ITIN and phone number choose the type of tax payment you want to make and select Next. 100s of Top Rated Local Professionals Waiting to Help You Today. The state income tax rate is 323.

In the top right corner click on New to INTIME. We last updated the Estimated. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax.

If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. This means you may.

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Cell Phone Tax Wireless Taxes Fees Tax Foundation

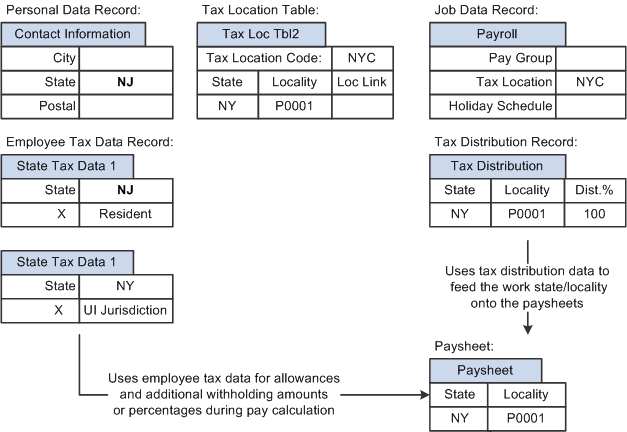

Peoplesoft Payroll For North America 9 1 Peoplebook

Solved Indiana Withholding Setup In Quickbooks Payroll

A State By State Guide For Each Irs Mailing Address Workest

Ranking State And Local Sales Taxes Tax Foundation

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Cryptocurrency Taxes What To Know For 2021 Money

Helpful Sales Tax Steps For Amazon Fba Sellers Amazon Fba Business Sales Tax Tax Return

Dor Make Estimated Tax Payments Electronically

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Economic Nexus Laws By State Taxconnex

Tax Burden By State 2022 State And Local Taxes Tax Foundation